The only plastic we need for travel.

Tonik Digital Bank in 2026: Is This Digital Bank Still Worth It?

Digital banking has become part of everyday life for many Filipinos, and by 2026, having at least one digital bank account is no longer a novelty. Among the early players in the space is Tonik Digital Bank, which launched in 2021 as the Philippines’ first neobank and has since grown into a familiar name in the local digital finance scene.

So in 2026, with more digital banks available and competition getting tighter, is Tonik Digital Bank still worth using?

Tonik Digital Bank: Services and features

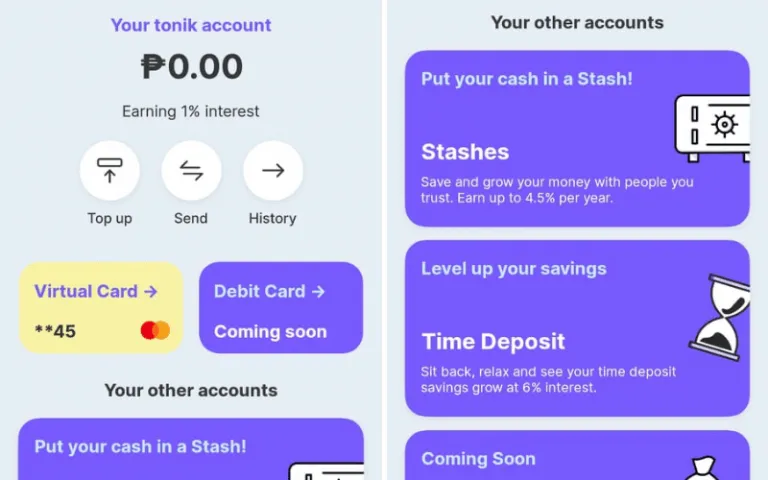

Basically, Tonik operates just like the traditional bank, only it relies solely on technology. It allows deposits, withdrawals, loans, payment, and even card products. Aside from the main account (1% interest p.a.), Tonik offers its users up to five stashes and five time deposit accounts.

What are stashes?

Stashes are digital wallets inside your Tonik account designed to help you save for specific goals. In 2026, Tonik still offers both Solo Stashing and Group Stashing, each typically earning higher interest than a regular savings account, subject to current terms and promotions.

Solo Stashing works well for personal goals such as building an emergency fund, saving for travel, or setting money aside for big purchases. Group Stashing allows users to save together with friends or family toward a shared goal, which can be useful for trips, celebrations, or joint expenses.

How does the Tonik time deposit work?

Time deposits remain one of Tonik’s most attractive features in 2026. Users can open time deposit accounts with competitive interest rates that may go up to 6 percent per annum, depending on the chosen term and ongoing promos.

There is no minimum deposit required, making this feature accessible even for first-time savers. Available terms usually range from six months to two years, allowing users to lock in funds based on their savings timeline.

How does the debit card work?

Every Tonik account comes with a free virtual debit card that can be used for online shopping, subscriptions, and bill payments. Users may also request a physical Mastercard for a one-time fee.

The physical card can be used for ATM withdrawals locally and overseas, with fees depending on the ATM provider rather than Tonik itself.

Also read: Here’s Why We Should Shift Towards Cashless Payments

How safe is the Digital Bank?

Security remains a top concern for digital bank users. Tonik is regulated by the Bangko Sentral ng Pilipinas, and deposits are insured by the Philippine Deposit Insurance Corporation for up to ₱500,000 per depositor.

These protections mean that Tonik operates under the same regulatory framework as traditional banks, offering users added peace of mind when saving digitally.

Is Tonik Digital Bank still worth it in 2026?

For users looking for structured savings tools, competitive interest rates, and a fully app-based banking experience, Tonik remains a solid option in 2026. Its stash and time deposit features continue to stand out, especially for those saving toward specific goals.

That said, as with any digital bank, it works best as part of a broader financial setup. Many users keep Tonik alongside traditional banks or other digital banks, depending on their needs.

Ultimately, whether Tonik is worth it in 2026 depends on how you plan to use it. If high interest savings, goal based features, and convenience matter to you, Tonik still holds its place in the growing digital banking space.

Published at

About Author

Danielle Uy

Subscribe our Newsletter

Get our weekly tips and travel news!

Recommended Articles

14 Best Credit Cards for Travel in the Philippines 118 Kilos of Shabu Discovered on Remote Bataan Beach A quiet Bataan beach turned into a crime scene after police seized 118 kilos of shabu worth ₱802M, abandoned near a lighthouse.

The 2021 Global Korea Scholarship Is Accepting Applications This March Don’t miss this chance!

LOOK: 2024 Holidays & Long Weekends in the Philippines Check out our downloadable cheat sheet!

21AM Digital Museum by CCP Launches on 25 Feb 2022 View the inaugural exhibition for free!

Latest Articles

Why Better Infrastructure Matters for Tourists in the Philippines Tourism beyond promos

PokéPark KANTO: How To Get Tickets And What To Expect At Tokyo’s New Pokémon Theme Park PokéPark KANTO is officially open at Yomiuriland!

You Now Need to Pay Travel Tax Before Completing Your eTravel Form Here’s a simple guide to avoid airport delays!

New 5-Year LTO Registration For Brand-New Cars And Motorcycles Only Check if your car or motorcycle qualifies for the LTO extension!

Frasco Now Wants Her Face Removed from PH Tourism Materials Ashamed of her main character syndrome?